Since the second half of 2019, pig raising has become the new wealth code. In addition to traditional pig breeding companies, real estate companies such as Vanke, Country Garden and some Internet companies have started to raise pigs. In 2020, pig companies have indeed made unprecedented profits. Tianbang shares have increased their profits by more than 1,000 times a year, but the result of relying on the sky is that the profits of pig companies will shrink sharply when the price of pigs falls after the year.

The pigs that fly into the air have a one-year profit exceeding 4.6 times the total since the listing

In fact, the same is true. As long as the pigs can be raised alive to the slaughter, a lot of money can be made. In this wave of pig cycles, the price of pork rose from about ten yuan a catty to more than fifty yuan a catty.

At present, most pig companies have disclosed performance data for 2020, which is basically a big increase as expected, and some even earn enough profits for decades in a year.

On April 21, Tianbang Co., Ltd. announced its 2020 performance report. It achieved operating income of 10.764 billion, a year-on-year increase of 79.2%, realized a net profit of 3.245 billion attributable to the parent, a year-on-year increase of 3131.98%, and realized a non-net profit of 3.312 billion, a year-on-year increase of 106917.13 %.

Interestingly, since Tianbang shares went public in 2007, its main business includes pig breeding and pork product processing, pig vaccines, pig feed and aquatic feed, and pig breeding technical services. Based on historical data as of 2019 It can be seen that the total net profit of the company attributable to the parent is only 702 million, and the net profit in 2020 is 4.6 times that.

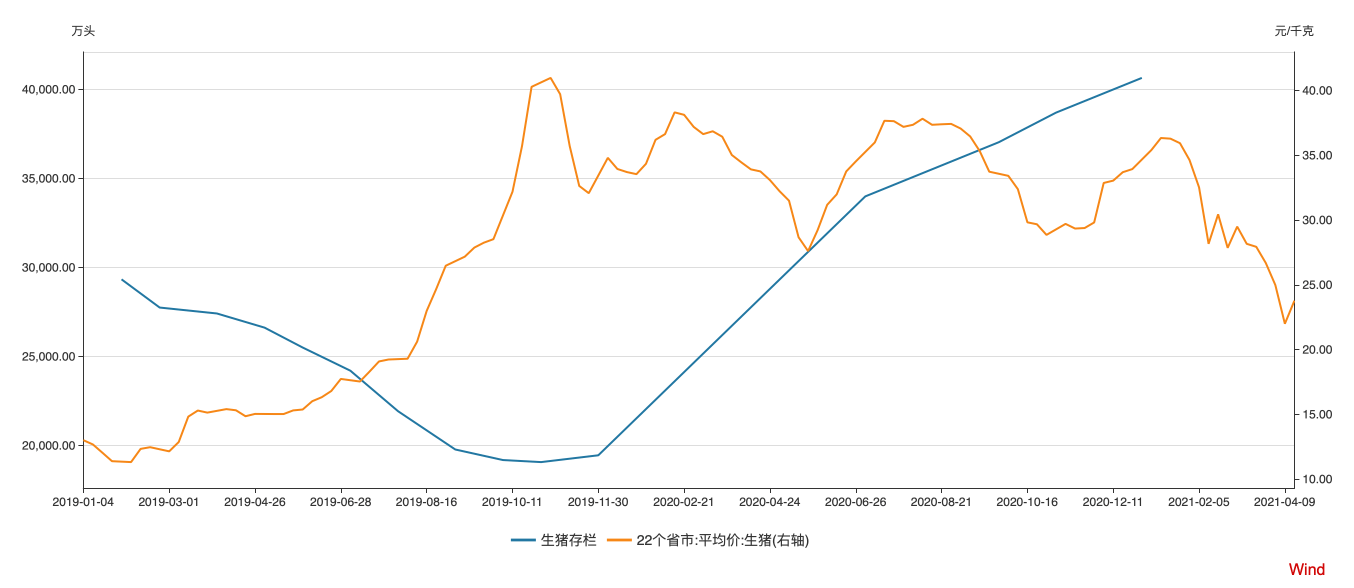

In other words, no matter how long this strong performance can last, Tianbang has made more than sixty years of profits in this year alone. Previously, due to the impact of African swine fever, the national pork production capacity fell off a cliff in 2019. Although it is in the process of recovery in 2020, the market is still in short supply, resulting in a high level of live pig market prices throughout the year.

According to data from the Ministry of Agriculture and Rural Affairs, the average price of live pigs in 2020 is 34.03 yuan/kg, a sharp increase of 60.36% year-on-year, while the annual report of Tianbang shares shows that the average sales price of the company’s multi-breed combination of live pigs reached 51.46 yuan/kg, an increase of 177% year-on-year . In addition, Tianbang shares achieved 3.0778 million pigs for slaughter throughout the year, an increase of 26.17% year-on-year. Among them, the number of breeding pigs for slaughter was 329,100, an increase of 515% year-on-year, and the number of piglets for slaughter was 1.687 million, an increase of 443% year-on-year. The main reason for the huge increase in company profits.

On the 22nd, Wen’s shares also published its annual report. In 2020, operating income was 74.923 billion, a year-on-year increase of 2.47%, but the net profit attributable to the parent was only 7.426 billion, a year-on-year decrease of 46.83%, and non-net profit was only 6.381 billion, a year-on-year decrease. 51.11%. Judging from the current leading pig companies that have publicly disclosed their performance, Wen’s shares are also the only pig company that has experienced negative profit growth.

Unlike Tianbang, which only breeds live pigs, Wen’s breeding business includes live pigs and white feather chickens and other poultry. In 2020, the revenue of pig farming will increase by 10.84% year-on-year, and the gross profit rate will increase by 1.74%. However, the revenue of broiler and other farming products fell by 9.3% and 1.92% respectively. Especially when the price of broiler chicken and the price of live pigs fluctuated in the opposite direction, the gross profit margin of the broiler business fell sharply by 25.93% to 0.38%, which is also the company’s net profit. One of the main reasons for the decline.

Pig prices fell, performance fell, piglet market enthusiasm continued

Unlike the elated annual report, the quarterly report of the pig company is full of sorrows.

From New Year’s Day to early April, pork prices were nearly cut in half, with a drop of 43.74%. Especially after the Spring Festival, market demand was weak. Since March, the price of pigs has continued to decline. As of April 9, the average domestic pig price was 20.84 yuan/kg, a drop of 30.99% from March 2.

A few days ago, the relevant person in charge of the Ministry of Agriculture and Rural Affairs also said that as the supply and demand situation continues to improve, pork prices have fallen for 12 consecutive weeks, falling to about 40 yuan per kilogram, a year-on-year decrease of about 25%. After April 9th, the pig price bottomed out and rebounded. As of the 21st, the pig price has experienced two short-term rebounds.

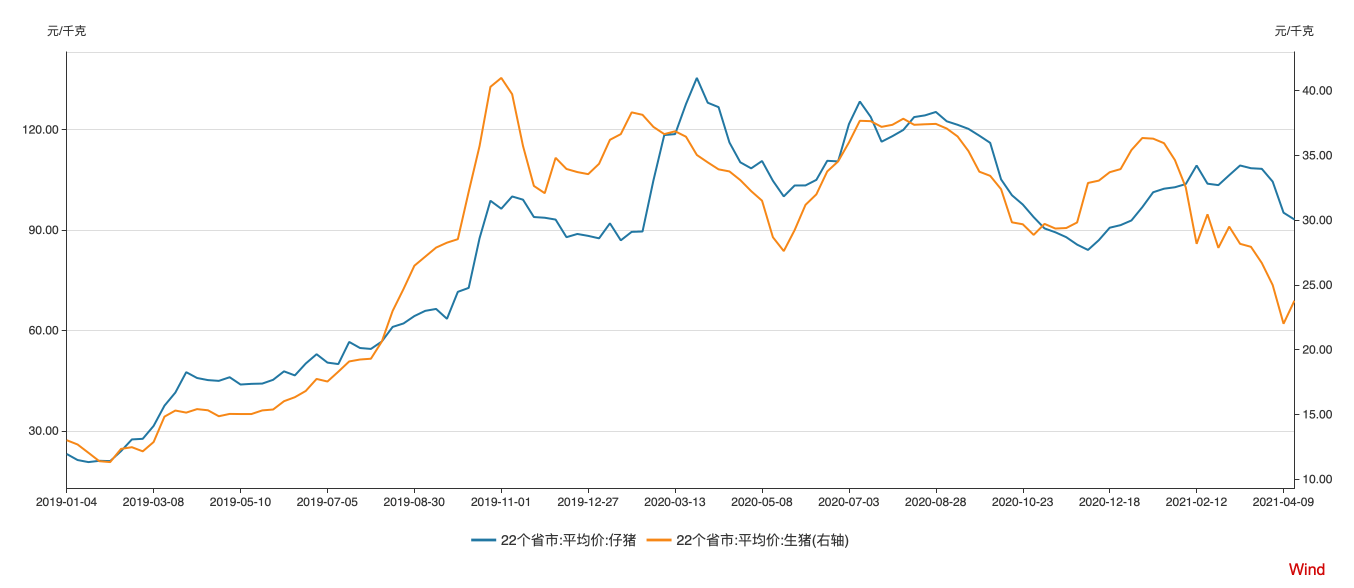

But at the same time, the cost of raising pigs has increased, with corn up 47.0% year-on-year, and compound feed for fat pigs up 16.1% year-on-year. Pig prices fell and feed prices climbed. In the end, the price of pigs and grains fell rapidly. In late March, it fell to around 9.23, and it was as high as 20 in the same period in 2020. It is currently falling back to the level of August 2019.

In such a market environment, the quarterly reports of pig companies have almost all fallen. The profit of Tianbang shares shrank to 191 million to 238 million, a year-on-year decrease of 50%-60%. Zhengbang’s net profit also fell to 205 million to 305 million, a year-on-year decrease of 66.32%-77.36%. Wen’s shares realized net profit attributable to the parent 544 million, a year-on-year decrease of 71.28%.

The reason is mostly due to the sharp decline in domestic pig prices and the superimposed increase in corn and other feed prices to squeeze profits. In addition, the slaughter structure of live pigs is also known as one of the other major influencing factors. Early elimination of some sows and early slaughter of fat pigs to avoid the risk of epidemic accounted for a relatively high proportion, while breeding pigs and piglets accounted for a relatively small proportion.

At present, only Muyuan’s first quarterly report has achieved growth. The company expects the net profit attributable to the mother will reach 6.7 billion to 7.3 billion, an increase of 62.17%-76.7% year-on-year. The company said that it was due to the expansion of the scale of pig farming and sales of 7.72 million pigs in the first quarter. , An increase of 201.09% year-on-year.

In fact, my country has always been a big country for pig breeding and consumption. However, due to various factors, it has been plagued by the “pig cycle” all the year round. This time, after many real estate companies and Internet companies have entered the pig breeding market, can they change the problem? The situation of the neck may be the point.

Different from the volatility and decline of live pig prices, since December 2020, piglet prices have risen steadily. Even if they decline after the year, they are still higher than the live pig market prices. From this perspective, the market supply has more momentum for continuous pig raising. .

Perhaps it is a question of the uncertainty of the pig breeding sales market. The live pig futures listed on DCE have continued to fluctuate and fall after the market plummeted, and the pork sector in the secondary market is also more negative than positive. (Blue Whale Capital Xu Xiaochun [email protected])

You must log in to post a comment.